Trading is a lot like golf. It may be the best analogy that I can find that relates another activity with trading. Like trading, it is a solitary sport. The biggest similarity I see is the importance of avoiding disasters. The Big Miss. You can be the best golfer in the world for 16 out of 18 holes, but if you make a mistake and go on tilt, lose your mind, and put up a triple bogey in the other 2 holes, you will not win.

Trading is a lot like golf. It may be the best analogy that I can find that relates another activity with trading. Like trading, it is a solitary sport. The biggest similarity I see is the importance of avoiding disasters. The Big Miss. You can be the best golfer in the world for 16 out of 18 holes, but if you make a mistake and go on tilt, lose your mind, and put up a triple bogey in the other 2 holes, you will not win.

Just like trading. You can be the best trader in the world on 9 out of 10 days, but that 1 day out of 10, or even 1 day out of 20, where you lose your mind, go on tilt, chase losses, revenge trade, and act on raw emotion and not calculated logic will blow away all your gains, and if taken to the extreme, the point of no return where your capital is crippled beyond repair. Remember, if you blow up and lose 90% of your capital, it takes a 900% return to get back to even. Trading is unforgiving of big misses. Unlike golf, they ruin careers, not just a match.

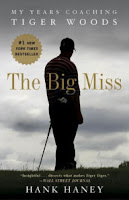

In a book about Tiger Woods, The Big Miss, the most memorable section of the book was not the accounts of Tiger Woods acting like a jerk, but how he was a calculating golfer who erred on the safe side, who would rather push a ball a little to the right rather than try to be perfect and risk a drive that takes a big hook to the left. He was the opposite of Phil Mickelson, who always tried to be perfect, who took big risks to try to get birdies.

While it is true that you cannot win in trading without an edge, the next most important thing after finding an edge is to avoid disasters. The best way is to trade small, not to trade with a tight stop. The bigger your edge, the more that tight stops hurt you, not help you. The worse the trader, the more important it is to cut losses. The better the trader, the more important it is to trade small and avoid disasters to get into the long run.Although it’s commonly thought that Tiger plays go-for-broke golf and tries the most difficult shots with no fear, it’s a false image. Tiger is, above all, a calculating golfer who plays percentages and makes sure to err on the safe side.

We had a little scary dip on Thursday, but it was quickly bought up. Still expecting new highs for the year in the coming weeks.

2 comments:

Can you elaborate on how tight stop contribute to trading disasters?

Where did I say tight stops lead to trading disasters? Reread the post. They lower profitability for good traders.

Post a Comment