When you are on the sidelines watching but not actively engaging in the market, you often miss the good entry waiting for the perfect entry. I hardly traded the SPX all year until this month, and it was the wrong side. A lot of regret over what happened this month, not so much getting long too early, but not catching the good short opportunity in late March/early April. That last gasp rally after Powell's dovish performance at the March FOMC was the "nothing to worry about" top.

Part of my reluctance to get short in late March was the strong seasonal tendencies for April, which is historically one of the strongest months of the year. But it also coincided with a big capital gains year in 2023 which would cause some selling to raise cash for tax payments. But I ignored my own analysis about rallies being vulnerable to a sustained selloff after 4-5 months of nonstop uptrend price action. It just so happened that the top on April 1 was almost exactly 5 months after the October 27, 2023 bottom in SPX.

Definitely a lot of regret about how I've played it, but there will be more chances this year as the upper bound of the SPX seems to be somewhat defined, as I expect SPX 5250-5300 to be a ceiling for at least the next few months. For at least the next 3 months, there should be range bound trading which will favor fading short term moves to catch intermediate term mean reversions. With how steep the uptrend has been after the SPX broke 4800 and went to all time highs, it will take a few months to consolidate those gains as valuations are very high. Also, with rate cuts being pushed out, the positive catalyst that many had relied on as their backstop is in question. With consensus now focused on sticky inflation, after 3 hotter than expected CPI numbers, that thinking has permeated to the Fed, who always acts with a lag. I expect a less dovish/more hawkish Powell in the next couple of months, regardless of the inflation numbers and economic data that come out. That should put a ceiling on any rallies in the next 3 months.

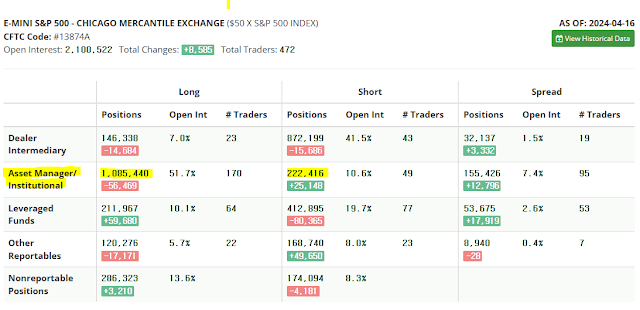

But there are also bullish data points that are popping up after the past 3 weeks. Positioning has gotten lighter among asset managers in the COT data. Asset manager net longs in SPX are now down to mid September 2023 levels, when the SPX was trading in the 4500s. Historically, large asset manager net long positions are when the market is most vulnerable to a sudden big selloff. The purge in positioning makes it less likely you get much more sustained selling in the short term.

Here is positioning data for funds coming from Factset. The data seems a bit off, considering what I hear on CNBC/Bloomberg, but it shows funds as being positioned quite defensively with overweights in low beta stocks and non-cyclicals.

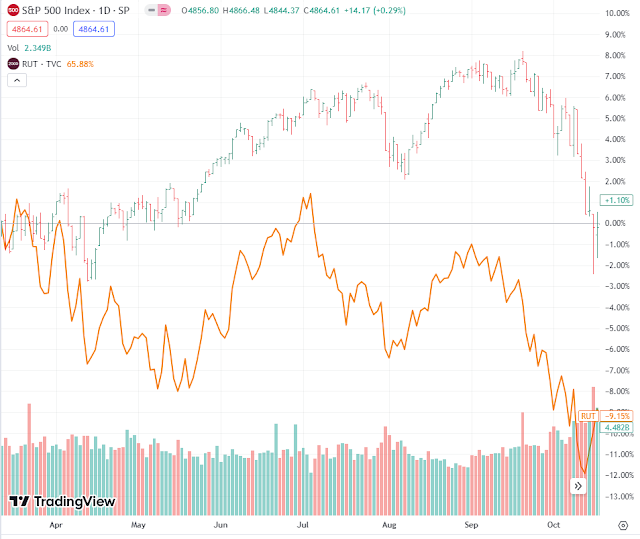

Here is more positioning data from JP Morgan Intelligence. It shows the 4 week change in positioning. Long positioning is now much lighter after the intense selling in the past few weeks.

CTA trend follower data that I have been tracking show the biggest trend following ETF (IMGP) now net short SPX. It appears the CTA have mostly abandoned ship and will no longer be providing more selling pressure to this market.

With a huge group of earnings announcements coming out this week, we will be coming out of stock buyback blackout period by next week, which should bring supportive corporate buyback flows in May. I still see some headwinds from a very weak bond market, which I think could extend into early May, after what I expect to be a hawkish Powell at the May FOMC meeting. That keeps me from becoming really bullish here. But by middle of May, I see room for a medium term move higher for SPX.

We got nasty META earnings yesterday, giving us a healthy gap down. I trimmed longs earlier this week, and will look to re-add exposure on any dips today and tomorrow. I still expect a few more days of a bounce after the intense opex selloff last week.